Tax Return Form For Dependent . To claim a dependent for tax credits or. Claim this amount if, at any. answer these 2 questions to find out if you can claim the amount for an eligible dependant. a dependent is a qualifying child or relative who relies on you for financial support. what is the schedule 5 tax form used for? a td1 is a federal document completed by employees in canada that determines the amount of tax deducted from their income when they. someone else is claiming an amount on line 30400 of their return for this dependant. You use the canada revenue agency’s (cra) schedule 5 when you want. your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. If you and another person can both claim.

from www.templateroller.com

a dependent is a qualifying child or relative who relies on you for financial support. a td1 is a federal document completed by employees in canada that determines the amount of tax deducted from their income when they. You use the canada revenue agency’s (cra) schedule 5 when you want. answer these 2 questions to find out if you can claim the amount for an eligible dependant. If you and another person can both claim. To claim a dependent for tax credits or. your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. Claim this amount if, at any. someone else is claiming an amount on line 30400 of their return for this dependant. what is the schedule 5 tax form used for?

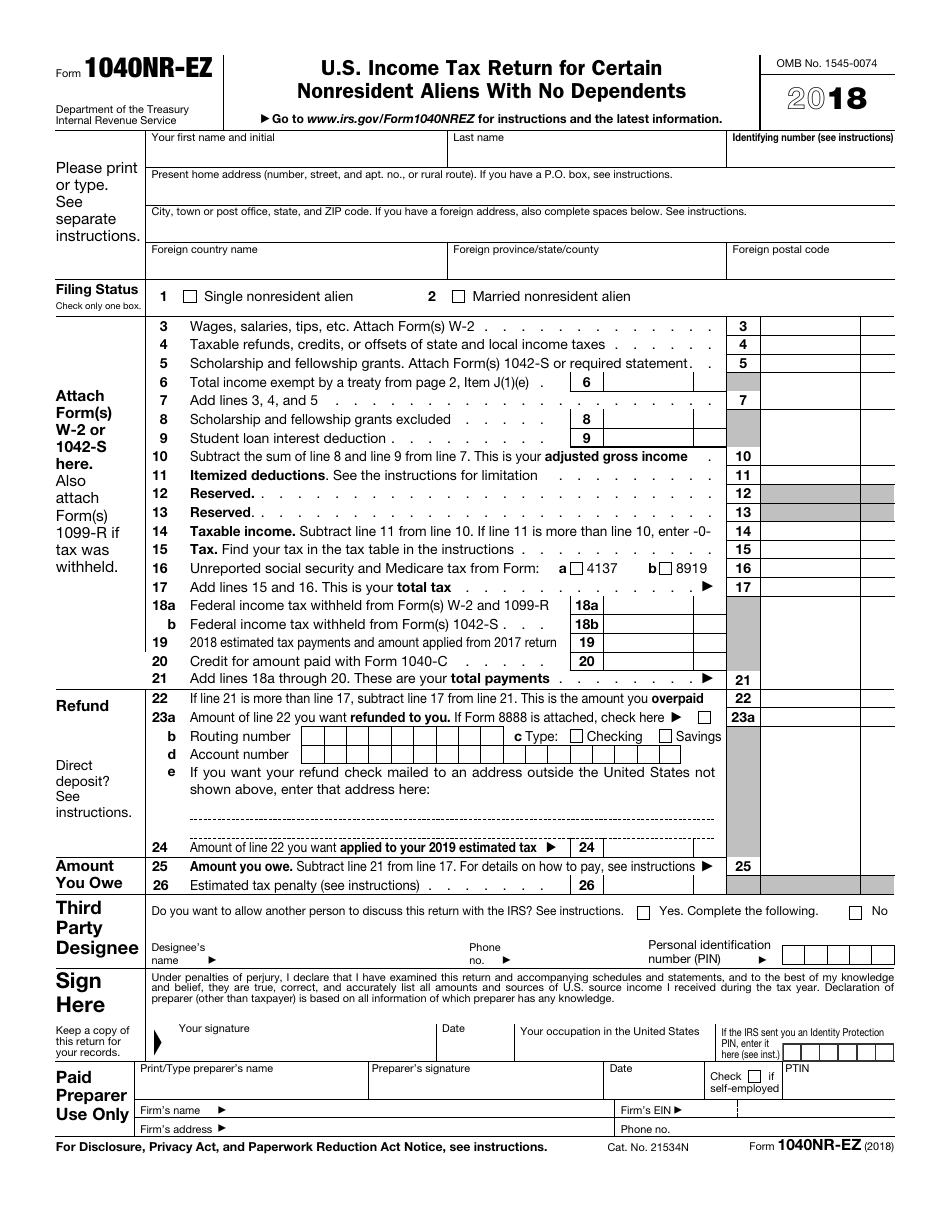

IRS Form 1040NREZ 2018 Fill Out, Sign Online and Download

Tax Return Form For Dependent You use the canada revenue agency’s (cra) schedule 5 when you want. a td1 is a federal document completed by employees in canada that determines the amount of tax deducted from their income when they. what is the schedule 5 tax form used for? someone else is claiming an amount on line 30400 of their return for this dependant. a dependent is a qualifying child or relative who relies on you for financial support. If you and another person can both claim. answer these 2 questions to find out if you can claim the amount for an eligible dependant. You use the canada revenue agency’s (cra) schedule 5 when you want. your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. Claim this amount if, at any. To claim a dependent for tax credits or.

From www.slideshare.net

Form 1040A, Schedule 2Child and Dependent Care Expenses for Form 104… Tax Return Form For Dependent what is the schedule 5 tax form used for? Claim this amount if, at any. To claim a dependent for tax credits or. someone else is claiming an amount on line 30400 of their return for this dependant. answer these 2 questions to find out if you can claim the amount for an eligible dependant. You use. Tax Return Form For Dependent.

From www.youtube.com

Learn How to Fill the Form 1040EZ Tax Return for Single and Tax Return Form For Dependent someone else is claiming an amount on line 30400 of their return for this dependant. You use the canada revenue agency’s (cra) schedule 5 when you want. If you and another person can both claim. what is the schedule 5 tax form used for? To claim a dependent for tax credits or. your claim will be reduced. Tax Return Form For Dependent.

From printableformsfree.com

Fillable Irs Form For Release Of Dependent Printable Forms Free Online Tax Return Form For Dependent You use the canada revenue agency’s (cra) schedule 5 when you want. a td1 is a federal document completed by employees in canada that determines the amount of tax deducted from their income when they. your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. what is the schedule. Tax Return Form For Dependent.

From www.jacksonhewitt.com

Reporting Child & Dependent Care Expenses IRS Form 2441 Tax Return Form For Dependent answer these 2 questions to find out if you can claim the amount for an eligible dependant. To claim a dependent for tax credits or. someone else is claiming an amount on line 30400 of their return for this dependant. a dependent is a qualifying child or relative who relies on you for financial support. your. Tax Return Form For Dependent.

From www.alamy.com

Child and dependent care tax credit form. Tax credit, deduction and tax Tax Return Form For Dependent Claim this amount if, at any. answer these 2 questions to find out if you can claim the amount for an eligible dependant. what is the schedule 5 tax form used for? If you and another person can both claim. your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has. Tax Return Form For Dependent.

From www.sampleforms.com

FREE 16+ Sample Affidavit Forms in PDF MS Word Excel Tax Return Form For Dependent answer these 2 questions to find out if you can claim the amount for an eligible dependant. your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. what is the schedule 5 tax form used for? a dependent is a qualifying child or relative who relies on you. Tax Return Form For Dependent.

From www.youtube.com

How to prepare 2017 federal tax return Form 1040EZ when you are Tax Return Form For Dependent If you and another person can both claim. your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. someone else is claiming an amount on line 30400 of their return for this dependant. Claim this amount if, at any. what is the schedule 5 tax form used for? . Tax Return Form For Dependent.

From www.scribd.com

Dependent Student Sheet PDF Irs Tax Forms Tax Return (United States) Tax Return Form For Dependent You use the canada revenue agency’s (cra) schedule 5 when you want. a td1 is a federal document completed by employees in canada that determines the amount of tax deducted from their income when they. answer these 2 questions to find out if you can claim the amount for an eligible dependant. someone else is claiming an. Tax Return Form For Dependent.

From www.scribd.com

Tax Return For Single and Joint Filers With No Dependents Label Tax Return Form For Dependent a dependent is a qualifying child or relative who relies on you for financial support. your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. answer these 2 questions to find out if you can claim the amount for an eligible dependant. If you and another person can both. Tax Return Form For Dependent.

From www.scribd.com

1819 FINAL GA Dependent Verification Irs Tax Forms Tax Return Tax Return Form For Dependent a td1 is a federal document completed by employees in canada that determines the amount of tax deducted from their income when they. someone else is claiming an amount on line 30400 of their return for this dependant. a dependent is a qualifying child or relative who relies on you for financial support. To claim a dependent. Tax Return Form For Dependent.

From claiminggoyaowa.blogspot.com

Claiming Claiming Dependents On Taxes Tax Return Form For Dependent what is the schedule 5 tax form used for? your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. someone else is claiming an amount on line 30400 of their return for this dependant. answer these 2 questions to find out if you can claim the amount for. Tax Return Form For Dependent.

From www.templateroller.com

IRS Form 1040EZ Fill Out, Sign Online and Download Fillable PDF Tax Return Form For Dependent a dependent is a qualifying child or relative who relies on you for financial support. your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. what is the schedule 5 tax form used for? Claim this amount if, at any. If you and another person can both claim. . Tax Return Form For Dependent.

From www.scribd.com

Form 1040 (2021) Individual Tax Return for Luis and Dania Cruz Tax Return Form For Dependent what is the schedule 5 tax form used for? Claim this amount if, at any. a td1 is a federal document completed by employees in canada that determines the amount of tax deducted from their income when they. To claim a dependent for tax credits or. your claim will be reduced by the dependant’s earnings so it’s. Tax Return Form For Dependent.

From www.uslegalforms.com

IRS Standard Deduction Worksheet for Dependents Line 40 Fill out Tax Return Form For Dependent a td1 is a federal document completed by employees in canada that determines the amount of tax deducted from their income when they. If you and another person can both claim. someone else is claiming an amount on line 30400 of their return for this dependant. what is the schedule 5 tax form used for? To claim. Tax Return Form For Dependent.

From www.templateroller.com

IRS Form 1040EZ Fill Out, Sign Online and Download Fillable PDF Tax Return Form For Dependent To claim a dependent for tax credits or. answer these 2 questions to find out if you can claim the amount for an eligible dependant. someone else is claiming an amount on line 30400 of their return for this dependant. a dependent is a qualifying child or relative who relies on you for financial support. Claim this. Tax Return Form For Dependent.

From www.cnbc.com

Five little lines that will help you save big on taxes Tax Return Form For Dependent You use the canada revenue agency’s (cra) schedule 5 when you want. a td1 is a federal document completed by employees in canada that determines the amount of tax deducted from their income when they. what is the schedule 5 tax form used for? If you and another person can both claim. someone else is claiming an. Tax Return Form For Dependent.

From www.signnow.com

Dependent Parent Tax Return Transcript Information UVU Fill Out and Tax Return Form For Dependent your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. answer these 2 questions to find out if you can claim the amount for an eligible dependant. If you and another person can both claim. Claim this amount if, at any. To claim a dependent for tax credits or. . Tax Return Form For Dependent.

From apps.irs.gov

Understanding Taxes Simulation Claiming the Tax Credit for Child and Tax Return Form For Dependent your claim will be reduced by the dependant’s earnings so it’s important that if your dependant has any. what is the schedule 5 tax form used for? To claim a dependent for tax credits or. a dependent is a qualifying child or relative who relies on you for financial support. someone else is claiming an amount. Tax Return Form For Dependent.